The aim of the EU Carbon-Border Adjustment Mechanism (CBAM) to prevent carbon leakage is admirable.

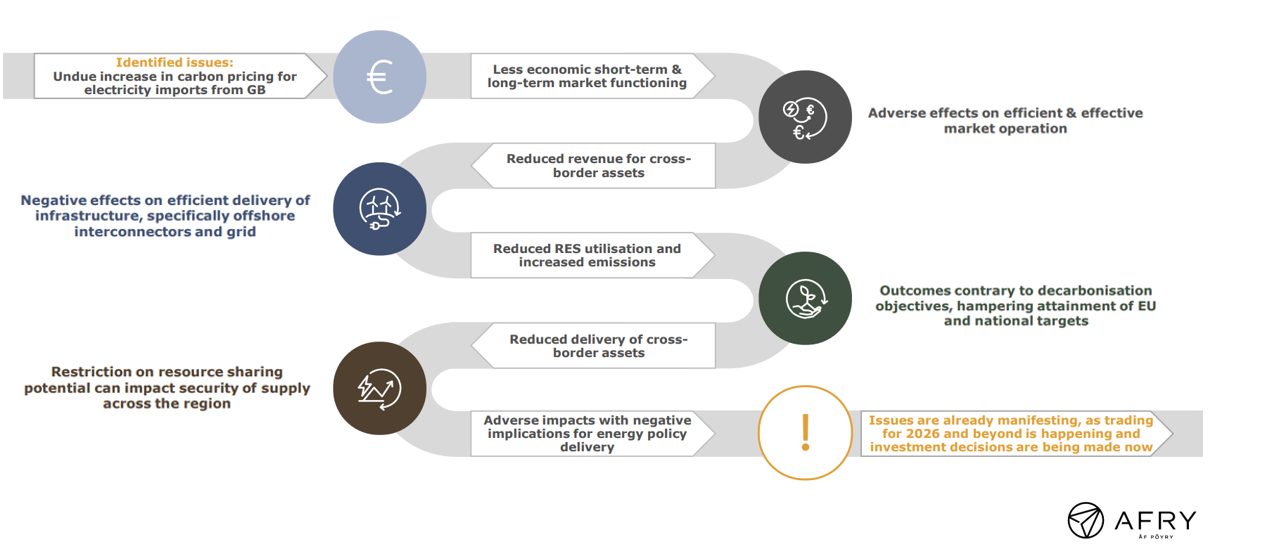

However, the detailed legislative proposals currently don’t consider well how electricity is traded in practice. Nemo Link expects that this will most likely lead to a double and/or unnecessary carbon taxation on electricity imported into the EU. Currently carbon-free imports would be even penalized more than electricity originating from thermal power plants.

In particular the CBAM drafting assumes by default that all imports of electricity from Third Countries are originating from fossil power plants. The current legislative drafting also makes it also very hard to consider the actual carbon content for imported electricity. This fails to consider renewable sources of electricity as export drivers and could discourage green electricity imports from outside the EU in the future.

In addition, in order to be eligible for a rebate against CBAM costs, an importer to the EU must provide proof that the goods they are importing have had a specific carbon price paid in the third country. However, this might not work well for one of the key sectors covered by CBAM, electricity, as it is virtually impossible to track the carbon price paid by electricity as most electricity, like an interchangeable commodity, is commonly traded nationally/internationally via anonymous exchange based transactions which makes a direct administrative trail between the producer and importer almost impossible to establish.

Once the EU CBAM is financially introduced, imports of electricity into the EU from third countries are expected to materially decrease, not because they are more carbon intensive than their EU equivalents, but simply due to the increased compliance costs and double and/or unnecessary carbon taxation. This is expected to lead to increased power prices in the EU.

The decreased imports are expected to lead to an increased activation of less efficient power plants in the EU and an increased curtailment of renewable plant output in the Third Countries. Both would lead to an increase in CO2 emissions overall and this will mean that the main aim of the EU’s CBAM is not met.

This type of trade barrier could also negatively impact the further buildout of additional interconnections with Third Countries and negatively impact some of the GB-EU Multi-Purpose Interconnector projects that are currently being considered.

The EU-GB electricity trade is particularly exposed to the unintended consequences of the EU’s CBAM given the level of interconnectivity, the UK’s very ambitious renewable buildout and net zero targets. Currently it was even expected that GB would have become over time a net exporter of electricity towards the EU. Especially in times of high RES output the EU was expected to be importing electricity from GB.

Given the expected impacts we urge EU policy makers to incorporate some changes to the latest CBAM legislative drafting.

Some minor wording changes on Article 9 that deals with the determination of the Carbon price paid in the country of origin would already be very beneficial.

Given the advanced stages of the CBAM negotiations, and to keep open the possibility for further (needed) changes/clarifications, it is important that the proposed review clause (Art.30) is sufficiently broad so as to allow such/clarifications changes to EU CBAM Regulation well-before its targeted financial implementation.

In the presentation prepared by Nemo Link (here) more information can be found on the topic (from a EU-GB perspective) and also some suggested wording changes to the latest legislative CBAM drafting are included.

Action is needed to ensure efficient use of cross-border capacity. The report highlighted mitigation options as follows:

Action is needed to ensure efficient use of cross-border capacity. The report highlighted mitigation options as follows: